ISO 20022 accounts payable

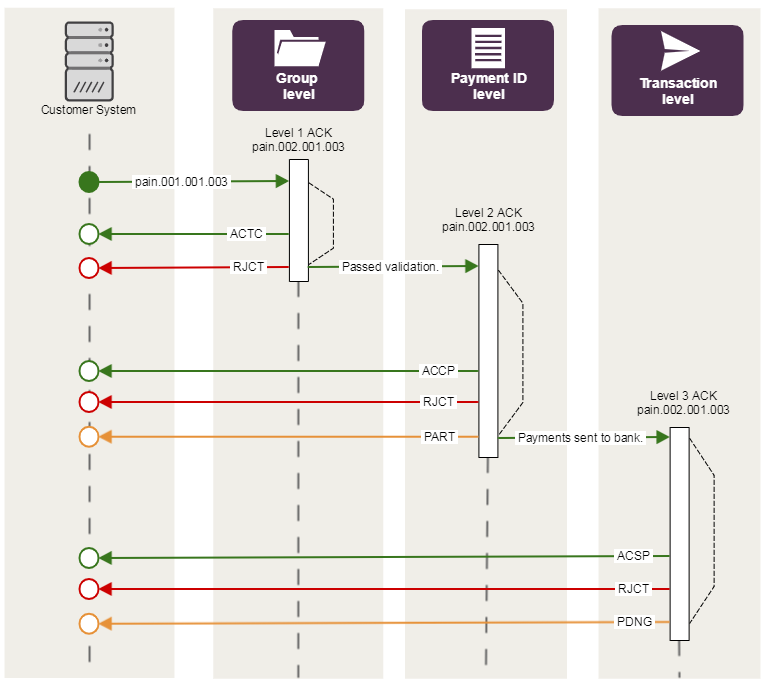

Accounts payable processes use ISO 20022 pain.001.001.03 and pain.002.001.03 messages according to the CGI (Common Global Implementation).

PaymentsPlus consumes and produces these files:

- Transmit a pain.001.001.03 payment import file to PaymentsPlus to send Australian and New Zealand payments.

- PaymentsPlus responds with three levels of pain.002.001.03 remittance messages.

St. George customers

This file format is not available to customers of St. George.Launch the ISO 20022 accounts payable sandbox

Use the sandbox to validate that the format of your pain.001.001.03 file is correct. The sandbox:

- allows you to upload a pain.001.001.03 file of up to 200kb,

- responds with the location of any errors in your file, or the details of any payments when successful,

- does not guarantee that payments will process successfully, only that the format of the file is correct,

- does not take into account the types of payments that are accepted by your PaymentsPlus facility, and

- does not perform duplicate checking.

Data considerations

See Australian domestic payment currencies for important data considerations.

Australian Direct Entry (EFT)

- The total count of Australian Direct Entry (EFT) transactions in a file cannot exceed 999,999

File validation

ISO pain.001.001.03 files are validated according to the XML schema on ISO 20022 Payments messages. Files that do not meet the schema requirements will be rejected.

PaymentsPlus performs additional validation to ensure your facility is able to send the payments in the file.

pain.001.001.03

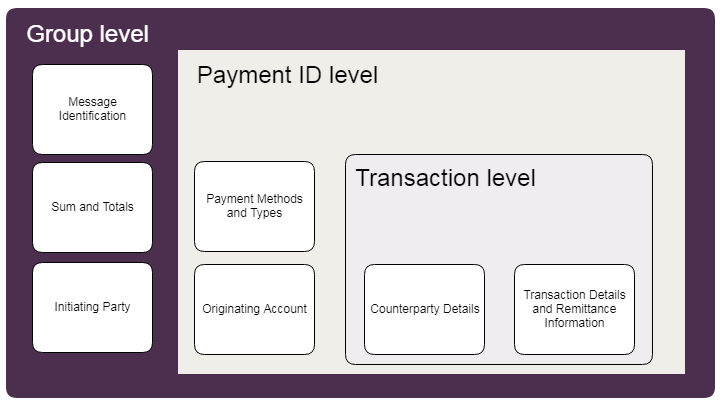

The structure of a Payment Initiation pain.001.001.03 payment import file is:

-

One block at the 'Group Level'

- One 'Message Identification'

- One 'Sum and Totals'

- One 'Initiating Party'

-

One block at the 'Payment ID Level'

- One 'Payment Methods and Types'

- One 'Originating Account'

-

One or more blocks at the 'Transaction Level'

- One 'Counterparty Details'

- One or more payment records

- Zero or more remittance records

- Zero or more invoice records

Important: Please refer to the v3 XSD for specific validation rules https://www.iso20022.org/message_archive.page#PaymentsInitiation3.

Group level

| Lev | ISO XML element | Message Item | Req | Len | Format | Example, Description or element name |

|---|---|---|---|---|---|---|

| 1 | <Document> |

M | ||||

| 2 | <CstmrCdtTrfInitn> |

Customer Credit Transfer Initiation | M | <CstmrCdtTrfInitn> |

||

| 3 | <GrpHdr> |

Group Header | M | <GrpHdr> |

||

| 4 | <MsgId> |

Message Identification | M | 1-35 | 1000044716 |

|

| 4 | <CreDtTm> |

Creation Date Time | M | 19 | TZ format | 2018-12-14T14:05:41 |

| 4 | <NbOfTxs> |

Number Of Transactions | M | 1-15 | Numeric | 3 |

| 4 | <CtrlSum> |

Control Sum | M | 1-18 | Amount | 30865.64 |

| 4 | <InitgPty> |

Initiating Party | M | <InitgPty> |

||

| 5 | <Nm> |

Name | M | 1-140 | ABC Corporation |

Payment ID level

| Lev | ISO XML element | Message Item | Req | Len | Format | Example, Description or element name |

|---|---|---|---|---|---|---|

| 3 | <PmtInf> |

PaymentInformation | M | <PmtInf> |

||

| 4 | <PmtInfId> |

PaymentInformationIdentification | M | 1-20 | Alphanumeric | The lodgement reference that will end up on the remitter's bank statement. For AU DE, the first 18 characters are used. For NZ DE the first 12 characters are used. |

| 4 | <PmtMtd> |

PaymentMethod | M | 3 | List of codes | TRF for DE, OTT, BPAY and RTGS. CHK for Cheques. See Specifying the payment method. |

| 4 | <NbOfTxs> |

NumberOfTransactions | M | 1-15 | Numeric | Total number of transactions within a Payment Information batch. |

| 4 | <CtrlSum> |

ControlSum | O | 1-18 | Amount, including cents Optional to include. If included, value will be checked. | |

| 4 | <PmtTpInf> |

PaymentTypeInformation | M | <PmtTpInf> |

||

| 5 | <InstrPrty> |

InstructionPriority | M | NORM | NORM - all processed as normal priority. |

|

| 5 | <SvcLvl> |

ServiceLevel | M | <SvcLvl> |

||

| 6 | <Cd> |

Code | O | List of codes | Use NURG for BPAY, DE, or Cheque payments. Use URGP for OTT and RTGS transactions. Otherwise do not include. See Specifying the payment method. |

|

| 5 | <LclInstrm> |

LocalInstrument | O | <LclInstrm> Include these elements only for BPAY and OTT transactions |

||

| 6 | <Cd> |

Code | O | IN for OTT payments. Otherwise do not include. See Specifying the payment method. |

||

| 6 | <Prtry> |

Proprietary | O | Use BPAY for BPAY payments. Otherwise do not include. See Specifying the payment method. |

||

| 4 | <ReqdExctnDt> |

RequestedExecutionDate | M | yyyy-MM-dd |

The date that the file is sent for processing. A file with a past date is automatically sent for processing upon being authorised, or immediately if file authorisation is not enabled. | |

| 4 | <Dbtr> |

Debtor | M | <Dbtr> |

||

| 5 | <Nm> |

Name | M | 1-140 | Name of submitting customer, not used in validation. | |

| 5 | <PstlAdr> |

Postal Address | O | Alphanumeric | <PstlAdr> |

|

| 6 | <StrtNm> |

Street Name | O | 1-70 | Alphanumeric | |

| 6 | <BldgNb> |

BuildingNumber | O | 1-16 | The combined maximum length of <BldgNb> and <StrtNm> is 86 characters. |

|

| 6 | <TwnNm> |

Town Name | O | 1-35 | Alphanumeric | |

| 6 | <CtrySubDvsn> |

Country Subdivision (State) | O | Alphanumeric | ||

| 6 | <Ctry> |

Country | O | Alphanumeric | ||

| 5 | <CtryOfRes> |

Country of Residence | O | ISO Country Code | For example AU |

|

| 4 | <DbtrAcct> |

DebtorAccount | M | <DbtrAcct> - this branch contains the funding account number |

||

| 5 | <Id> |

M | 1-35 | <Id> |

||

| 6 | <Othr> |

M | <Othr> |

|||

| 7 | <Id> |

M | The account number | |||

| 5 | <Ccy> |

Currency | O | 3 | The currency of the funding account. Used when initiating an OTT with exchange. | |

| 4 | <DbtrAgt> |

DebtorAgent | M | <DbtrAgt> This branch contains the funding account BSB |

||

| 5 | <FinInstnId> |

M | <FinInstnId> |

|||

| 6 | <BIC> |

M | Code | WPACAU2S for Australian domiciled accounts, WPACNZ2W for New Zealand domiciled accounts. |

||

| 6 | <ClrSysMmbId> |

M | <ClrSysMmbId> |

|||

| 7 | <MmbId> |

M | 1-35 | BSB or NZ bank and branch code | The funding BSB, e.g. 032000, 032-000 or bank code + branch code for New Zealand. |

|

| 6 | <PstlAdr> |

O | <PstlAdr> |

|||

| 7 | <Ctry> |

M | ISO country code | For example AU |

||

| 5 | <BrnchId> |

M | <BrnchId> |

|||

| 6 | <Id> |

M | The funding BSB for Australia, e.g. 032000 or bank code and branch code for New Zealand. For OTT payments this will be used as the BSB/Routing Code if the <MmbId> field is not provided. |

|||

| 4 | <ChrgBr> |

ChargeBearer | O | SHAR or DEBT | The international charge bearer code to apply to this transaction. Available values are SHAR - Fees shared between payer and beneficiary and DEBT - Fees paid by ordering customer (payer). Note This is only available as part of a premium solution, this feature needs to be agreed and enabled by Westpac Implementation before use. If the feature is not enabled before processing it is ignored and the facility default will be used instead |

Transaction level

| Lev | ISO XML element | Message Item | Req | Len | Format | Example, Description or element name |

|---|---|---|---|---|---|---|

| 4 | <CdtTrfTxInf> |

CreditTransferTransactionInformation | M | <CdtTrfTxInf> |

||

| 5 | <PmtId> |

PaymentIdentification | M | <PmtId> |

||

| 6 | <InstrId> |

InstructionIdentification | O | 1-35 | Appears in pain.002.001.03 and on screens in PaymentsPlus but is not passed through to the recipient with the payment. | |

| 6 | <EndToEndId> |

EndToEndIdentification | M | Variable | Payment Reference. This value is sent with payment from debtor to creditor as it travels through the clearing system. For length restrictions and payment channel specific information see Specifying the End To End Id. | |

| 5 | <Amt> |

Amount | M |

|

||

| 6 | <InstdAmt Ccy="AAA"> |

InstructedAmount | M | 1-10 | Amount, currency specified. Maximum 9999999.99. |

Payment amount. Different limits may apply per payment type or currency. |

| 5 | <XchgRateInf> |

ExchangeRateInformation | O | <XchgRateInf> - this block is optional, include if there is an exchange rate deal negotiated. |

||

| 6 | <XchgRate> |

ExchangeRate | O | 6-13 | ||

| 6 | <RateTp> |

RateType | O | |||

| 6 | <CtrctId> |

ContractIdentification | O | 1-16 | ||

| 5 | <ChrgBr> |

ChargeBearer | O | 4 | SHAR or DEBT | The international charge bearer code to apply to this transaction. Available values are SHAR - Fees shared between payer and beneficiary and DEBT - Fees paid by ordering customer (payer). Note This is only available as part of a premium solution, this feature needs to be agreed and enabled by Westpac Implementation before use. If the feature is not enabled before processing it is ignored and the facility default will be used instead |

| 5 | <ChqInstr> |

ChequeInstruction | O | |||

| 6 | <ChqTp> |

ChequeType | O | 4 | List of codes | BCHQ for Bank cheques CCHQ for Corporate cheques |

| 6 | <ChqNb> |

ChequeNumber | O | 1-7 | Cheque numbers must be either all provided, or not provided at all. Appears as Cheque No:on standard remittances. It is recommended that this value be unique for each payment. Whether or not the customer will provide cheque numbers will be arranged during implementation. | |

| 6 | <DlvryMtd> |

DeliveryMethod | O | <DlvryMtd> |

||

| 7 | <Cd> |

Code | O | 4-6 | List of codes | See table for more details, valid values include: MLDB*, *MLCD*, *MLFA, CRDB, CRCD, CRFA, PUDB, PUCD, PUFA, RGDB, RGCD, RGFA* |

| 6 | <InstrPrty> |

InstructionPriority | M | 4 | NORM |

NORM |

| 6 | <ChqMtrtyDt> |

ChequeMaturityDate | O | 10 | yyyy-MM-dd |

E.g. 2018-12-14 |

| 6 | <FrmsCd> |

FormsCode | O | 2 | 2 digits | Remittance layout code, speak with your Westpac Implementation manager for valid values. |

| 6 | <MemoFld> |

MemoField | O | Alphanumeric | Remittance footer value | |

| 5 | <UltmtDbtr> |

UltimateDebtor | O | Can be included optionally, speak with your Westpac implementation manager if this is required. | ||

| 6 | <Nm> |

Name | M | Name of submitting customer. | Optional remitter name to use with an outgoing AU EFT payment (only). Only the first 16 characters are used and if a name is not provided, the current account default will be used. | |

| 6 | <PstlAdr> |

Postal Address | O | Alphanumeric | <PstlAdr> |

|

| 5 | <IntrmyAgt1> |

Intermediary Agent | O | Populate if an intermediary SWIFT code is required for an OTT transaction, otherwise do not include. | ||

| 6 | <FinInstnId> |

FinancialInstitutionIdentification | O | <FinInstnId> |

||

| 7 | <BIC> |

Intermediary SWIFT Code | O | 8 or 11 exactly | A valid BIC for OTT transactions. If an intermediary SWIFT code is required populate it here, otherwise do not include. | |

| 5 | <CdtrAgt> |

CreditorAgent | O | Populate Creditor Agent for financial institution details for the creditor's account, See Specifying the account | ||

| 6 | <FinInstnId> |

FinancialInstitutionIdentification | M | <FinInstnId> |

||

| 7 | <BIC> |

BIC | O | 8 or 11 exactly | A valid BIC for OTT transactions. Otherwise do not include. See Specifying the account. | |

| 7 | <ClrSysMmbId> |

ClearingSystemMemberIdentification | O | <ClrSysMmbId> |

||

| 8 | <Cd> |

Code | O | 5 | List of codes | |

| 8 | <Prtry> |

Proprietary | O | |||

| 8 | <MmbId> |

MemberIdentification | M | AUBSB for OTT, RTGS, DE. BillerNumber for BPAY transactions. Otherwise do not include the <ClrSysMmbId> node. |

||

| 7 | <Nm> |

Name | O | |||

| 6 | <BrnchId> |

BranchIdentification | O | |||

| 7 | <Id> |

Identification | O | A valid Sort Code for OTT payments, a valid BSB for DE and RTGS payments; or a valid BPAY biller number for BPAY payments. Otherwise do not include. See Specifying the account. | ||

| 5 | <Cdtr> |

Creditor | O | |||

| 6 | <Nm> |

Name | O | 1-128 | 128 Characters | Required for AU DE, RTGS, NZ DE, AU OTT, and OSKO PayId payments. For AU OTT payments this is sent with the payment instruction as the name on the payment. Note CdtrAcct/Nm may be used depending on your individual setup. |

| 6 | <PstlAdr> |

PostalAddress | O | <PstlAdr> |

||

| 7 | <AdrTp> |

AddressType | O | |||

| 7 | <Dept> |

Department | O | |||

| 7 | <SubDept> |

SubDepartment | O | |||

| 7 | <StrtNm> |

StreetName | O | The combined maximum length of <BldgNb> and <StrtNm> is 86 characters. Mandatory for OTT. |

||

| 7 | <BldgNb> |

BuildingNumber | O | The combined maximum length of <BldgNb> and <StrtNm> is 86 characters. |

||

| 7 | <PstCd> |

PostCode | O | 1-16 | Mandatory for OTT when <Ctry> is AU. |

|

| 7 | <TwnNm> |

TownName | O | 1-35 | Mandatory for OTT. | |

| 7 | <CtrySubDvsn> |

CountrySubDivision | O | 1-35 | ||

| 7 | <Ctry> |

Country | O | Mandatory for OTT | ||

| 6 | <CtctDtls> |

ContactDetails | O | |||

| 7 | <EmailAdr> |

EmailAddress | O | 1-256 | Email address | Email address for PayId payments |

| 7 | <Nm> |

Name | O | 1-140 | Organisation name for PayId payments | |

| 5 | <CdtrAcct> |

CreditorAccount | O | Include the recipient's account information. | ||

| 6 | <Id> |

Identification | O | |||

| 7 | <IBAN> |

IBAN | O | 1-35 | A valid IBAN for OTT and RTGS transactions. Otherwise do not include. See Specifying the account. | |

| 7 | <Othr> |

Other | O | |||

| 8 | <Id> |

Identification | O | 1-20 | The account number for DE, OTT and RTGS transactions when an IBAN is not provided; or a valid CRN for BPAY payments. Otherwise do not include. | |

| 6 | <Nm> |

Name | O | 1-70 | Account name. For NZ OTT transactions this will be sent with the payment instruction as the name on the payment. Note Cdtr/Nm may be used depending on your individual setup. |

|

| 5 | <Tax> |

Tax | O | |||

| 6 | <Cdtr> |

Creditor | O | |||

| 7 | <TaxId> |

TaxIdentification | O | Alphanumeric | Creditor's tax identification | |

| 5 | <RltdRmtInf> |

RelatedRemittanceInformation | O | |||

| 6 | <RmtId> |

RemittanceIdentification | O | |||

| 6 | <RmtLctnMtd> |

RemittanceLocationMethod | O | 3-4 | List of codes | EMAL for EMAIL, POST for mailed remittance. |

| 6 | <RmtLctnElctrncAdr> |

RemittanceLocationElectronicAddress | O | 1-20 for telephone numbers, 4-256 for email addresses. | The telephone number, fax number or email address. | |

| 5 | <RmtInf> |

RemittanceInformation | O | |||

| 6 | <Ustrd> |

Unstructured | O | 1-140 | If included for an Osko/X2P1 or AU OTT transaction the first two Ustrd fields will be passed along with the payment instruction. | |

| 6 | <Strd> |

Structured | O | A maximum of 2000 |

||

| 7 | <RfrdDocInf> |

ReferredDocumentInformation | O | |||

| 8 | <Tp> |

Type | O | |||

| 9 | <CdOrPrtry> |

CodeOrProprietary | O | |||

| 10 | <Cd> |

Code | O | |||

| 10 | <Prtry> |

Proprietary | O | |||

| 9 | <Issr> |

Issuer | O | |||

| 8 | <Nb> |

Number | O | 1-35 | Invoice Description. Appears as Invoice Description on standard remittances. |

|

| 8 | <RltdDt> |

RelatedDate | O | The date the invoice was issued. Appears as Invoice Date on standard remittances. |

||

| 7 | <RfrdDocAmt> |

ReferredDocumentAmount | O | |||

| 8 | <DuePyblAmt Ccy="AAA"> |

DuePayableAmount | O | The amount of the invoice. Appears as Invoice Amount on standard remittances. |

||

| 8 | <DscntApldAmt Ccy="AAA"> |

DiscountAppliedAmount | O | |||

| 8 | <CdtNoteAmt Ccy="AAA"> |

CreditNoteAmount | O | |||

| 8 | <TaxAmt Ccy="AAA"> |

TaxAmount | O | |||

| 8 | <AdjstmntAmtAndRsn> |

AdjustmentAmountAndReason | O | |||

| 9 | <Amt Ccy="AAA"> |

Amount | O | The amount of the deduction/discount. Appears as Deduction Amount on standard remittances. |

||

| 8 | <CdtDbtInd> |

CreditDebitIndicator | O | |||

| 8 | <Rsn> |

Reason | O | |||

| 8 | <AddtlInf> |

AdditionalInformation | O | |||

| 8 | <RmtdAmt Ccy="AAA"> |

RemittedAmount | O | The paid amount of the invoice. Appears as Amount Paid on standard remittances. |

||

| 7 | <CdtrRefInf> |

CreditorReferenceInformation | O | |||

| 8 | <Ref> |

Reference | O | Invoice Number. Printed remittances are limited to 10 chars. Appears as Invoice Number on standard remittances. |

||

| 7 | <AddtlRmtInf> |

AdditionalRemittanceInformation | O | Extra remittance data can be passed through under this element, speak with your Westpac implementation manager if this is required. |

Specifying the payment method

When specifying a payment channel varying pain.001.001.03 elements need to be populated. Refer to the tables below:

Australian payment channels

<PmtInf><DbtrAgt><FinInstnId><BIC> starts with WPACAU.

| Payment Channel | <PmtMtd> |

<PmtTpInf><SvcLvl><Cd> |

<PmtTpInf><LclInstrm><Cd> |

<PmtTpInf><LclInstrm><Prtry> |

|---|---|---|---|---|

| AU DE | TRF |

NURG |

||

| AU RTGS | TRF |

URGP |

||

| AU OTT | TRF |

URGP |

IN |

|

| AU Cheque | CHK |

NURG |

||

| AU BPay | TRF |

NURG |

BPAY |

|

| AU Osko | TRF |

X2P1 |

New Zealand payment channels

<PmtInf><DbtrAgt><FinInstnId><BIC> starts with WPACNZ.

| Payment Channel | <PmtMtd> |

<PmtTpInf><SvcLvl><Cd> |

<PmtTpInf><LclInstrm><Cd> |

|---|---|---|---|

| NZ DE | TRF |

NURG |

|

| NZ OTT | TRF |

URGP |

IN |

| NZ Cheque | CHK |

NURG |

Specifying the amount

| Payment Channel | Maximum payment amount |

|---|---|

| Australian Direct Entry (EFT) | 99,999,999.99 |

| New Zealand Direct Entry (EFT) | 9,999,999.99 |

| OSKO | 500,000,000.00 |

Specifying the funding account

This is how to specify the funding account for a payment.

| Payment Channel | Field | Location | Format |

|---|---|---|---|

| Australian Channels | BSB | <DbtrAgt>\<FinInstnId>\<ClrSysMmbId>\<MmbId> |

Numeric, nnn-nnn or nnnnnn |

| Account Number | <DbtrAcct>\<Id>\<Othr>\<Id> |

Numeric | |

| New Zealand Channels | Bank Code and Branch Code | <DbtrAgt>\<FinInstnId>\<ClrSysMmbId>\<MmbId> |

Numeric in the format {Bank:Branch} with lengths {2:4}. E.g 032002 for bank 03 and branch 2002. |

| Account Number and Suffix | <DbtrAcct>\<Id>\<Othr>\<Id> |

Numeric in the format {Account Number:Suffix} with lengths {7:2} or {8:4}. E.g. 100000101 for account number 1000001 and suffix 01. |

|

| New Zealand Foreign Currency | Foreign currency account number | <DbtrAcct>\<Id>\<Othr>\<Id> |

As provided during facility setup. Do not include a value for <DbtrAgt>\<FinInstnId>\<ClrSysMmbId>\<MmbId> when using an FCA. |

Specifying the destination account

Domestic

For domestic transactions use the following fields to specify the account.

| Payment Channel | Field | Location | Format |

|---|---|---|---|

| Australian Direct Entry/RTGS | BSB | <CdtrAgt>\<FinInstnId>\<ClrSysMmbId>\<MmbId> |

|

| Account Number | <CdtrAcct>\<Id>\<Othr>\<Id> |

||

| NZ Direct Entry | Bank + Branch | <CdtrAgt>\<FinInstnId>\<ClrSysMmbId>\<MmbId> |

Numeric in the format {bank:branch} with lengths {4:2}. E.g 032002 for bank 03 and branch 2002. |

| Account Number + Suffix | <CdtrAcct>\<Id>\<Othr>\<Id> |

Numeric in the format {Account Number:Suffix} with lengths {7:2} or {8:4}. E.g. 100000101 for account number 1000001 and suffix 01. |

|

| BPay | Biller Number | <CdtrAgt>\<FinInstnId>\<ClrSysMmbId>\<MmbId> |

|

| CRN | <CdtrAcct>\<Id>\<Othr>\<Id> |

||

| OSKO/X2P1 | Account Identifier | <CdtrAcct>\<Id>\<Othr>\<SchmeNm> |

One of: BBAN, TELI, EMAL, AUBN, ORGN |

| Short name (Account holder name) | <CdtrAcct>\<Nm> |

For PayId payments this needs to match the name against the PayId | |

| BSB + Account Number (BBAN) | <CdtrAcct>\<Id>\<Othr>\<Id> |

||

| Telephone Number (TELI) | <CdtrAcct>\<Id>\<Othr>\<Id> |

This should be the fully qualified telephone number with + and - included. E.g. +99-99999999 |

|

| Australian Business Number (AUBN) | <CdtrAcct>\<Id>\<Othr>\<Id> |

||

| Email Address (EMAL) | <Cdtr>\<CtctDtls>\<EmailAdr> |

||

| Orangisation Name (ORGN) | <Cdtr>\<CtctDtls>\<Nm> |

International

EUR Countries

- Typically, an IBAN is used for any of the 34 countries in the SEPA (Single Euro Payments Area).

Non-EUR Countries

- Usually only a SWIFT code and account number is necessary.

All Countries

- If a vendor specifically asks to use a BSB/routing code, set it as per below.

| Field | Required | Location |

|---|---|---|

| SWIFT Code | Yes | <CdtrAgt>\<FinInstnId>\<BIC> |

| BSB/Routing Code | When provided by Vendor/Payee | <CdtrAgt>\<FinInstnId>\<ClrSysMmbId>\<MmbId> If <MmbId> is blank, <CdtrAgt>/<BrnchId>/<Id> will be used. |

| IBAN | When not using Account Number | <CdtrAcct>\<Id>\<IBAN> |

| Account Number | When not using IBAN | <CdtrAcct>\<Id>\<Othr>\<Id> |

Specifying the End To End Id

| Payment Channel | Reference Name | Min/Max Length | Format | Description |

|---|---|---|---|---|

| Australian Direct Entry (EFT) | Recipient Reference (Lodgement Reference) | 1/18 | Alphanumeric | This will be the lodgement reference that appears on the payee's bank statement. It is recommended that this value be unique for each payment. Appears as Reference No: on standard remittances. Invalid characters will be removed. |

| New Zealand Direct Entry (EFT) | Payee Analysis | 1/12 | Alphanumeric | This will be the analysis reference that appears on the payee bank statement. - Some receiving institutions expect this to be numeric |

| Osko | End To End ID | 1/35 | Alphanumeric | A reference assigned by the initiating party to unambiguously identify the payment. This identifier is passed on unchanged throughout the entire end-to-end payment flow. The end-to-end identification can be used for reconciliation or to link tasks relating to the payment. |

| Cheque | Recipient Reference (Cheque Number) | 1/7 | Numeric | The cheque number of the cheque to be issued. Appears as Cheque No:on standard remittances. It is recommended that this value be unique for each payment. Whether or not the customer will provide cheque numbers will be arranged during implementation. |

| BPAY | Recipient Reference (BPAY CRN) | 1/20 | Numeric | BPAY Customer Reference Number. Appears as CRN:on standard remittances. |

| RTGS | Recipient Reference (Lodgement Reference) | 1/16 | Alphanumeric | This reference will be included as part of the credit transaction data appearing on the payee bank statement as WBC PAYPLUS-<Reference>. <Reference> may be truncated by the receiving bank. It is recommended that this value be unique for each payment. Appears as Reference No: on standard remittances. |

| OTT | Recipient Reference | 1/16 | Alphanumeric | This reference will be included as part of the credit transaction data appearing on the payee bank statement as WBC PAYPLUS-<Reference>. <Reference> may be truncated by the receiving bank. It is recommended that this value be unique for each payment. Appears as Reference No:on standard remittances. |

Sample files

See these pain.001.001.003 payment import files:

- Direct Entry payment

- OTT payment

- OTT payment with dealer rate

- RTGS payment

- Cheque payment

- BPAY payment

- Osko payment

Direct Entry payment

<Document

xmlns:xsd="http://www.w3.org/2001/XMLSchema"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"

xmlns="urn:iso:std:iso:20022:tech:xsd:pain.001.001.03">

<CstmrCdtTrfInitn>

<GrpHdr>

<MsgId>1000044716</MsgId>

<CreDtTm>2018-12-14T14:05:41</CreDtTm>

<NbOfTxs>7</NbOfTxs>

<CtrlSum>30865.64</CtrlSum>

<InitgPty>

<Nm>TEST PAYER</Nm>

</InitgPty>

</GrpHdr>

<PmtInf>

<PmtInfId>1000044716</PmtInfId>

<PmtMtd>TRF</PmtMtd>

<NbOfTxs>7</NbOfTxs>

<CtrlSum>30865.64</CtrlSum>

<PmtTpInf>

<InstrPrty>NORM</InstrPrty>

<SvcLvl>

<Cd>NURG</Cd>

</SvcLvl>

</PmtTpInf>

<ReqdExctnDt>2018-12-14</ReqdExctnDt>

<Dbtr>

<Nm>TEST PAYER</Nm>

<PstlAdr>

<StrtNm>123 Fake Street</StrtNm>

<BldgNb>Level 6</BldgNb>

<TwnNm>Melbourne</TwnNm>

<CtrySubDvsn>VIC</CtrySubDvsn>

<Ctry>AU</Ctry>

</PstlAdr>

<CtryOfRes>AU</CtryOfRes>

</Dbtr>

<DbtrAcct>

<Id>

<Othr>

<Id>123465</Id>

</Othr>

</Id>

<Ccy>AUD</Ccy>

</DbtrAcct>

<DbtrAgt>

<FinInstnId>

<BIC>WPACAU2S</BIC>

<ClrSysMmbId>

<MmbId>032-002</MmbId>

</ClrSysMmbId>

<PstlAdr>

<Ctry>AU</Ctry>

</PstlAdr>

</FinInstnId>

<BrnchId>

<Id>303 Collins Street</Id>

</BrnchId>

</DbtrAgt>

<CdtTrfTxInf>

<PmtId>

<InstrId>01-210045000139362019</InstrId>

<EndToEndId>210045000139362019</EndToEndId>

</PmtId>

<Amt>

<InstdAmt Ccy="AUD">67.38</InstdAmt>

</Amt>

<CdtrAgt>

<FinInstnId>

<ClrSysMmbId>

<MmbId>032-002</MmbId>

</ClrSysMmbId>

<Nm>WBC</Nm>

</FinInstnId>

<BrnchId>

<Id>Garden City</Id>

</BrnchId>

</CdtrAgt>

<Cdtr>

<Nm>CUSTOMER NAME</Nm>

<PstlAdr>

<PstCd>2601</PstCd>

<TwnNm>Canberra City</TwnNm>

<CtrySubDvsn>Aus</CtrySubDvsn>

<Ctry>AU</Ctry>

</PstlAdr>

<Id>

<OrgId>

<Othr>

<Id>CUSTOMER NAME-0000000001</Id>

</Othr>

</OrgId>

</Id>

</Cdtr>

<CdtrAcct>

<Id>

<Othr>

<Id>123465</Id>

</Othr>

</Id>

<Nm>CUSTOMER NAME</Nm>

</CdtrAcct>

<Tax>

<Dbtr>

<TaxId>40069396792</TaxId>

</Dbtr>

<RefNb>NSAG_REIMB</RefNb>

<Dt>2018-12-14</Dt>

<Rcrd>

<Tp>WHT</Tp>

<TaxAmt>

<TaxblBaseAmt Ccy="AUD">0.00</TaxblBaseAmt>

<TtlAmt Ccy="AUD">0.00</TtlAmt>

</TaxAmt>

</Rcrd>

</Tax>

</CdtTrfTxInf>

<CdtTrfTxInf>

<PmtId>

<InstrId>01-210045000139372019</InstrId>

<EndToEndId>210045000139372019</EndToEndId>

</PmtId>

<Amt>

<InstdAmt Ccy="AUD">18975.00</InstdAmt>

</Amt>

<CdtrAgt>

<FinInstnId>

<ClrSysMmbId>

<MmbId>032-002</MmbId>

</ClrSysMmbId>

<Nm>WBC</Nm>

<PstlAdr>

<Ctry>AU</Ctry>

</PstlAdr>

</FinInstnId>

<BrnchId>

<Id>Royal Exchange</Id>

</BrnchId>

</CdtrAgt>

<Cdtr>

<Nm>CUSTOMER NAME</Nm>

<PstlAdr>

<StrtNm>123 Fake Street</StrtNm>

<BldgNb>Level 6</BldgNb>

<PstCd>2010</PstCd>

<TwnNm>SURRY HILLS</TwnNm>

<CtrySubDvsn>New</CtrySubDvsn>

<Ctry>AU</Ctry>

</PstlAdr>

<Id>

<OrgId>

<Othr>

<Id>0000900796</Id>

</Othr>

</OrgId>

</Id>

</Cdtr>

<CdtrAcct>

<Id>

<Othr>

<Id>398127</Id>

</Othr>

</Id>

<Nm>CUSTOMER NAME</Nm>

</CdtrAcct>

<Tax>

<Dbtr>

<TaxId>40069396792</TaxId>

</Dbtr>

<RefNb>INV1015560</RefNb>

<Dt>2018-12-14</Dt>

<Rcrd>

<Tp>WHT</Tp>

<TaxAmt>

<TaxblBaseAmt Ccy="AUD">0.00</TaxblBaseAmt>

<TtlAmt Ccy="AUD">0.00</TtlAmt>

</TaxAmt>

</Rcrd>

</Tax>

</CdtTrfTxInf>

</PmtInf>

</CstmrCdtTrfInitn>

</Document>Cheque payment

<?xml version="1.0" encoding="UTF-8"?>

<Document

xmlns:xsd="http://www.w3.org/2001/XMLSchema"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"

xmlns="urn:iso:std:iso:20022:tech:xsd:pain.001.001.03">

<CstmrCdtTrfInitn>

<GrpHdr>

<MsgId>1002279829</MsgId>

<CreDtTm>2018-12-14T14:20:19</CreDtTm>

<NbOfTxs>1</NbOfTxs>

<CtrlSum>728.95</CtrlSum>

<InitgPty>

<Nm>TEST PAYER</Nm>

</InitgPty>

</GrpHdr>

<PmtInf>

<PmtInfId>12345678</PmtInfId>

<PmtMtd>CHK</PmtMtd>

<NbOfTxs>1</NbOfTxs>

<CtrlSum>728.95</CtrlSum>

<PmtTpInf>

<InstrPrty>NORM</InstrPrty>

<SvcLvl>

<Cd>NURG</Cd>

</SvcLvl>

</PmtTpInf>

<ReqdExctnDt>2018-12-14</ReqdExctnDt>

<Dbtr>

<Nm>TEST PAYER</Nm>

<PstlAdr>

<StrtNm>Lee Street</StrtNm>

<TwnNm>Sydney</TwnNm>

<CtrySubDvsn>NSW</CtrySubDvsn>

<Ctry>AU</Ctry>

</PstlAdr>

<CtryOfRes>AU</CtryOfRes>

</Dbtr>

<DbtrAcct>

<Id>

<Othr>

<Id>170489</Id>

</Othr>

</Id>

</DbtrAcct>

<DbtrAgt>

<FinInstnId>

<BIC>WPACAU2S</BIC>

<ClrSysMmbId>

<MmbId>032-001</MmbId>

</ClrSysMmbId>

<PstlAdr>

<Ctry>AU</Ctry>

</PstlAdr>

<Othr>

<Id>032</Id>

</Othr>

</FinInstnId>

<BrnchId>

<Id>032-001</Id>

</BrnchId>

</DbtrAgt>

<CdtTrfTxInf>

<PmtId>

<InstrId>01-200000010004702019</InstrId>

<EndToEndId>0001000470</EndToEndId>

</PmtId>

<Amt>

<InstdAmt Ccy="AUD">728.95</InstdAmt>

</Amt>

<ChrgBr>SHAR</ChrgBr>

<ChqInstr>

<ChqTp>BCHQ</ChqTp>

<ChqNb>1000470</ChqNb>

<DlvryMtd>

<Cd>MLCD</Cd>

</DlvryMtd>

<InstrPrty>NORM</InstrPrty>

<ChqMtrtyDt>2018-12-14</ChqMtrtyDt>

<FrmsCd>01</FrmsCd>

<MemoFld>Retain document for tax purposes</MemoFld>

</ChqInstr>

<Cdtr>

<Nm>TEST PAYER</Nm>

<PstlAdr>

<StrtNm>LOCKED BAG 1</StrtNm>

<PstCd>2000</PstCd>

<TwnNm>Sydney</TwnNm>

<CtrySubDvsn>NSW</CtrySubDvsn>

<Ctry>AU</Ctry>

</PstlAdr>

<Id>

<OrgId>

<Othr>

<Id>0081000802</Id>

</Othr>

</OrgId>

</Id>

</Cdtr>

<RltdRmtInf>

<RmtLctnMtd>POST</RmtLctnMtd>

</RltdRmtInf>

<RmtInf>

<Strd>

<RfrdDocInf>

<Tp>

<CdOrPrtry>

<Cd>CINV</Cd>

</CdOrPrtry>

</Tp>

<Nb>3100002653</Nb>

<RltdDt>2018-12-12</RltdDt>

</RfrdDocInf>

<RfrdDocAmt>

<DuePyblAmt Ccy="AUD">1457.40</DuePyblAmt>

<AdjstmntAmtAndRsn>

<Amt Ccy="AUD">0.00</Amt>

</AdjstmntAmtAndRsn>

<RmtdAmt Ccy="AUD">1457.40</RmtdAmt>

</RfrdDocAmt>

<CdtrRefInf>

<Tp>

<CdOrPrtry>

<Cd>SCOR</Cd>

</CdOrPrtry>

<Issr>ISO</Issr>

</Tp>

<Ref>HRPYM00006</Ref>

</CdtrRefInf>

</Strd>

<Strd>

<RfrdDocInf>

<Tp>

<CdOrPrtry>

<Cd>CREN</Cd>

</CdOrPrtry>

</Tp>

<Nb>3100002653</Nb>

<RltdDt>2018-12-12</RltdDt>

</RfrdDocInf>

<RfrdDocAmt>

<CdtNoteAmt Ccy="AUD">728.45</CdtNoteAmt>

</RfrdDocAmt>

<CdtrRefInf>

<Tp>

<CdOrPrtry>

<Cd>SCOR</Cd>

</CdOrPrtry>

<Issr>ISO</Issr>

</Tp>

<Ref>HRPYM00006</Ref>

</CdtrRefInf>

</Strd>

</RmtInf>

</CdtTrfTxInf>

</PmtInf>

</CstmrCdtTrfInitn>

</Document>BPAY payment

<?xml version="1.0"?>

<Document

xmlns:xsd="http://www.w3.org/2001/XMLSchema"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"

xmlns="urn:iso:std:iso:20022:tech:xsd:pain.001.001.03">

<CstmrCdtTrfInitn>

<GrpHdr>

<MsgId>16</MsgId>

<CreDtTm>2016-04-05T10:58:15.9515009+10:00</CreDtTm>

<NbOfTxs>2</NbOfTxs>

<CtrlSum>3.75</CtrlSum>

<InitgPty>

<Nm>TEST PAYER</Nm>

</InitgPty>

</GrpHdr>

<PmtInf>

<PmtInfId>16BPay</PmtInfId>

<PmtMtd>TRF</PmtMtd>

<NbOfTxs>2</NbOfTxs>

<CtrlSum>3.75</CtrlSum>

<PmtTpInf>

<SvcLvl>

<Cd>NURG</Cd>

</SvcLvl>

<LclInstrm>

<Prtry>BPAY</Prtry>

</LclInstrm>

</PmtTpInf>

<ReqdExctnDt>2016-04-05</ReqdExctnDt>

<Dbtr>

<Nm>TEST PAYER</Nm>

<PstlAdr>

<Ctry>AU</Ctry>

</PstlAdr>

</Dbtr>

<DbtrAcct>

<Id>

<Othr>

<Id>123465</Id>

</Othr>

</Id>

<Ccy>AUD</Ccy>

</DbtrAcct>

<DbtrAgt>

<FinInstnId>

<ClrSysMmbId>

<MmbId>032-002</MmbId>

</ClrSysMmbId>

<PstlAdr>

<Ctry>AU</Ctry>

</PstlAdr>

</FinInstnId>

<BrnchId>

<Id>032-002</Id>

</BrnchId>

</DbtrAgt>

<ChrgBr>DEBT</ChrgBr>

<CdtTrfTxInf>

<PmtId>

<InstrId>74</InstrId>

<EndToEndId>4072209021693770</EndToEndId>

</PmtId>

<Amt>

<InstdAmt Ccy="AUD">1.50</InstdAmt>

</Amt>

<CdtrAgt>

<FinInstnId>

<ClrSysMmbId>

<MmbId>111222</MmbId>

</ClrSysMmbId>

</FinInstnId>

</CdtrAgt>

<Cdtr>

<Nm>4072209021693770</Nm>

<PstlAdr>

<Ctry>AU</Ctry>

</PstlAdr>

</Cdtr>

<CdtrAcct>

<Id>

<Othr>

<Id>4072209021693770</Id>

</Othr>

</Id>

</CdtrAcct>

</CdtTrfTxInf>

<CdtTrfTxInf>

<PmtId>

<InstrId>75</InstrId>

<EndToEndId>4072209021693770</EndToEndId>

</PmtId>

<Amt>

<InstdAmt Ccy="AUD">2.25</InstdAmt>

</Amt>

<CdtrAgt>

<FinInstnId>

<ClrSysMmbId>

<MmbId>111222</MmbId>

</ClrSysMmbId>

</FinInstnId>

</CdtrAgt>

<Cdtr>

<Nm>4072209021693770</Nm>

<PstlAdr>

<Ctry>AU</Ctry>

</PstlAdr>

</Cdtr>

<CdtrAcct>

<Id>

<Othr>

<Id>4072209021693770</Id>

</Othr>

</Id>

</CdtrAcct>

</CdtTrfTxInf>

</PmtInf>

</CstmrCdtTrfInitn>

</Document>Osko payment

<Document

xmlns:xsd="http://www.w3.org/2001/XMLSchema"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"

xmlns="urn:iso:std:iso:20022:tech:xsd:pain.001.001.03">

<CstmrCdtTrfInitn>

<GrpHdr>

<MsgId>1000044716</MsgId>

<CreDtTm>2018-12-14T14:05:41</CreDtTm>

<NbOfTxs>7</NbOfTxs>

<CtrlSum>30865.64</CtrlSum>

<InitgPty>

<Nm>TEST PAYER</Nm>

</InitgPty>

</GrpHdr>

<PmtInf>

<PmtInfId>1000044716</PmtInfId>

<PmtMtd>TRF</PmtMtd>

<NbOfTxs>7</NbOfTxs>

<CtrlSum>30865.64</CtrlSum>

<PmtTpInf>

<InstrPrty>NORM</InstrPrty>

<LclInstrm>

<Prtry>X2P1</Prtry>

</LclInstrm>

</PmtTpInf>

<ReqdExctnDt>2018-12-14</ReqdExctnDt>

<Dbtr>

<Nm>TEST PAYER</Nm>

<PstlAdr>

<StrtNm>123 Fake Street</StrtNm>

<BldgNb>Level 6</BldgNb>

<TwnNm>Melbourne</TwnNm>

<CtrySubDvsn>VIC</CtrySubDvsn>

<Ctry>AU</Ctry>

</PstlAdr>

<CtryOfRes>AU</CtryOfRes>

</Dbtr>

<DbtrAcct>

<Id>

<Othr>

<Id>123465</Id>

</Othr>

</Id>

<Ccy>AUD</Ccy>

</DbtrAcct>

<DbtrAgt>

<FinInstnId>

<BIC>WPACAU2S</BIC>

<ClrSysMmbId>

<MmbId>032-003</MmbId>

</ClrSysMmbId>

<PstlAdr>

<Ctry>AU</Ctry>

</PstlAdr>

</FinInstnId>

<BrnchId>

<Id>303 Collins Street</Id>

</BrnchId>

</DbtrAgt>

<CdtTrfTxInf>

<PmtId>

<InstrId>01-210045000139362019</InstrId>

<EndToEndId>210045000139362019</EndToEndId>

</PmtId>

<Amt>

<InstdAmt Ccy="AUD">67.38</InstdAmt>

</Amt>

<CdtrAgt>

<FinInstnId>

<Nm>WBC</Nm>

<PstlAdr>

<Ctry>AU</Ctry>

</PstlAdr>

</FinInstnId>

<BrnchId>

<Id>Garden City</Id>

</BrnchId>

</CdtrAgt>

<Cdtr>

<Nm>CUSTOMER NAME</Nm>

<PstlAdr>

<PstCd>2601</PstCd>

<TwnNm>Canberra City</TwnNm>

<CtrySubDvsn>Aus</CtrySubDvsn>

<Ctry>AU</Ctry>

</PstlAdr>

<Id>

<OrgId>

<Othr>

<Id>CUSTOMER NAME-0000000001</Id>

</Othr>

</OrgId>

</Id>

</Cdtr>

<CdtrAcct>

<Id>

<Othr>

<Id>032003111116</Id>

<SchmeNm>

<Cd>BBAN</Cd>

</SchmeNm>

</Othr>

</Id>

<Nm>CUSTOMER NAME</Nm>

</CdtrAcct>

<Tax>

<Dbtr>

<TaxId>40069396792</TaxId>

</Dbtr>

<RefNb>NSAG_REIMB</RefNb>

<Dt>2018-12-14</Dt>

<Rcrd>

<Tp>WHT</Tp>

<TaxAmt>

<TaxblBaseAmt Ccy="AUD">0.00</TaxblBaseAmt>

<TtlAmt Ccy="AUD">0.00</TtlAmt>

</TaxAmt>

</Rcrd>

</Tax>

</CdtTrfTxInf>

<CdtTrfTxInf>

<PmtId>

<InstrId>01-210045000139372019</InstrId>

<EndToEndId>210045000139372019</EndToEndId>

</PmtId>

<Amt>

<InstdAmt Ccy="AUD">18975.00</InstdAmt>

</Amt>

<CdtrAgt>

<FinInstnId>

<ClrSysMmbId>

<MmbId>032-003</MmbId>

</ClrSysMmbId>

<Nm>WBC</Nm>

<PstlAdr>

<Ctry>AU</Ctry>

</PstlAdr>

</FinInstnId>

<BrnchId>

<Id>Royal Exchange</Id>

</BrnchId>

</CdtrAgt>

<Cdtr>

<Nm>CUSTOMER NAME</Nm>

<PstlAdr>

<StrtNm>123 Fake Street</StrtNm>

<BldgNb>Level 6</BldgNb>

<PstCd>2010</PstCd>

<TwnNm>SURRY HILLS</TwnNm>

<CtrySubDvsn>New</CtrySubDvsn>

<Ctry>AU</Ctry>

</PstlAdr>

<Id>

<OrgId>

<Othr>

<Id>0000900796</Id>

</Othr>

</OrgId>

</Id>

</Cdtr>

<CdtrAcct>

<Id>

<Othr>

<Id>032003111116</Id>

<SchmeNm>

<Cd>BBAN</Cd>

</SchmeNm>

</Othr>

</Id>

<Nm>CUSTOMER NAME</Nm>

</CdtrAcct>

<Tax>

<Dbtr>

<TaxId>40069396792</TaxId>

</Dbtr>

<RefNb>INV1015560</RefNb>

<Dt>2018-12-14</Dt>

<Rcrd>

<Tp>WHT</Tp>

<TaxAmt>

<TaxblBaseAmt Ccy="AUD">0.00</TaxblBaseAmt>

<TtlAmt Ccy="AUD">0.00</TtlAmt>

</TaxAmt>

</Rcrd>

</Tax>

<RmtInf>

<Ustrd>unstructured test line 1</Ustrd>

<Ustrd>unstructured test line 2</Ustrd>

</RmtInf>

</CdtTrfTxInf>

</PmtInf>

</CstmrCdtTrfInitn>

</Document>OTT payment

<?xml version="1.0" encoding="UTF-8"?>

<Document

xmlns:xsd="http://www.w3.org/2001/XMLSchema"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"

xmlns="urn:iso:std:iso:20022:tech:xsd:pain.001.001.03">

<CstmrCdtTrfInitn>

<GrpHdr>

<MsgId>1002278020</MsgId>

<CreDtTm>2018-12-14T12:08:23</CreDtTm>

<NbOfTxs>2</NbOfTxs>

<CtrlSum>10903.00</CtrlSum>

<InitgPty>

<Nm>TEST PAYER</Nm>

</InitgPty>

</GrpHdr>

<PmtInf>

<PmtInfId>1002278020</PmtInfId>

<PmtMtd>TRF</PmtMtd>

<NbOfTxs>2</NbOfTxs>

<CtrlSum>10903.00</CtrlSum>

<PmtTpInf>

<InstrPrty>NORM</InstrPrty>

<SvcLvl>

<Cd>URGP</Cd>

</SvcLvl>

<LclInstrm>

<Cd>IN</Cd>

</LclInstrm>

</PmtTpInf>

<ReqdExctnDt>2018-12-14</ReqdExctnDt>

<Dbtr>

<Nm>TEST PAYER</Nm>

<PstlAdr>

<StrtNm>Lee Street</StrtNm>

<TwnNm>Sydney</TwnNm>

<CtrySubDvsn>NSW</CtrySubDvsn>

<Ctry>AU</Ctry>

</PstlAdr>

<CtryOfRes>AU</CtryOfRes>

</Dbtr>

<DbtrAcct>

<Id>

<Othr>

<Id>123465</Id>

</Othr>

</Id>

<Ccy>AUD</Ccy>

</DbtrAcct>

<DbtrAgt>

<FinInstnId>

<BIC>WPACAU2S</BIC>

<ClrSysMmbId>

<MmbId>032-002</MmbId>

</ClrSysMmbId>

<PstlAdr>

<Ctry>AU</Ctry>

</PstlAdr>

<Othr>

<Id>032</Id>

</Othr>

</FinInstnId>

<BrnchId>

<Id>032-002</Id>

</BrnchId>

</DbtrAgt>

<CdtTrfTxInf>

<PmtId>

<InstrId>01-100080002083662019</InstrId>

<EndToEndId>8000208366</EndToEndId>

</PmtId>

<Amt>

<InstdAmt Ccy="AUD">6830.00</InstdAmt>

</Amt>

<ChrgBr>SHAR</ChrgBr>

<CdtrAgt>

<FinInstnId>

<BIC>GEBABEBB</BIC>

<ClrSysMmbId>

<MmbId>210</MmbId>

</ClrSysMmbId>

<Nm>BNP PARIBAS/ FORTIS BANK</Nm>

<PstlAdr>

<Ctry>BE</Ctry>

</PstlAdr>

</FinInstnId>

<BrnchId>

<Id>BRUSSELS</Id>

</BrnchId>

</CdtrAgt>

<Cdtr>

<Nm>CUSTOMER NAME</Nm>

<PstlAdr>

<StrtNm>TOUR SABLON</StrtNm>

<BldgNb>CUSTOMER TOWN</BldgNb>

<PstCd>1000</PstCd>

<TwnNm>TOWN</TwnNm>

<CtrySubDvsn>11</CtrySubDvsn>

<Ctry>BE</Ctry>

</PstlAdr>

<Id>

<OrgId>

<Othr>

<Id>0020018400</Id>

</Othr>

</OrgId>

</Id>

</Cdtr>

<CdtrAcct>

<Id>

<IBAN>BE85210047050106</IBAN>

</Id>

<Nm>CUSTOMER NAME</Nm>

</CdtrAcct>

<Tax>

<Cdtr>

<TaxId>BE0413393907</TaxId>

</Cdtr>

</Tax>

<RltdRmtInf>

<RmtLctnMtd>EMAL</RmtLctnMtd>

<RmtLctnElctrncAdr>test@customer.com</RmtLctnElctrncAdr>

</RltdRmtInf>

<RmtInf>

<Ustrd>Deal 343571</Ustrd>

<Strd>

<RfrdDocInf>

<Tp>

<CdOrPrtry>

<Cd>CINV</Cd>

</CdOrPrtry>

</Tp>

<Nb>1900047129</Nb>

<RltdDt>2018-11-15</RltdDt>

</RfrdDocInf>

<RfrdDocAmt>

<DuePyblAmt Ccy="AUD">6830.00</DuePyblAmt>

<AdjstmntAmtAndRsn>

<Amt Ccy="AUD">0.00</Amt>

</AdjstmntAmtAndRsn>

<RmtdAmt Ccy="AUD">6830.00</RmtdAmt>

</RfrdDocAmt>

<CdtrRefInf>

<Tp>

<CdOrPrtry>

<Cd>SCOR</Cd>

</CdOrPrtry>

<Issr>ISO</Issr>

</Tp>

<Ref>3184000436</Ref>

</CdtrRefInf>

</Strd>

</RmtInf>

</CdtTrfTxInf>

<CdtTrfTxInf>

<PmtId>

<InstrId>01-100080002083672019</InstrId>

<EndToEndId>8000208367</EndToEndId>

</PmtId>

<Amt>

<InstdAmt Ccy="AUD">4073.00</InstdAmt>

</Amt>

<ChrgBr>SHAR</ChrgBr>

<CdtrAgt>

<FinInstnId>

<BIC>KBBECH22XXX</BIC>

<ClrSysMmbId>

<MmbId>00790</MmbId>

</ClrSysMmbId>

<Nm>Berner Kantonalbank AG</Nm>

<PstlAdr>

<Ctry>CH</Ctry>

</PstlAdr>

</FinInstnId>

</CdtrAgt>

<Cdtr>

<Nm>CUSTOMER NAME</Nm>

<PstlAdr>

<StrtNm>132 NEUFELDSTRASSE</StrtNm>

<PstCd>3012</PstCd>

<TwnNm>BERN</TwnNm>

<CtrySubDvsn>BE</CtrySubDvsn>

<Ctry>CH</Ctry>

</PstlAdr>

<Id>

<OrgId>

<Othr>

<Id>0020028401</Id>

</Othr>

</OrgId>

</Id>

</Cdtr>

<CdtrAcct>

<Id>

<IBAN>CH8000790016271905163</IBAN>

</Id>

<Nm>CUSTOMER NAME</Nm>

</CdtrAcct>

<RltdRmtInf>

<RmtLctnMtd>EMAL</RmtLctnMtd>

<RmtLctnElctrncAdr>test@customer.com</RmtLctnElctrncAdr>

</RltdRmtInf>

<RmtInf>

<Ustrd>Deal 343572</Ustrd>

<Strd>

<RfrdDocInf>

<Tp>

<CdOrPrtry>

<Cd>CINV</Cd>

</CdOrPrtry>

</Tp>

<Nb>1900047542</Nb>

<RltdDt>2018-10-28</RltdDt>

</RfrdDocInf>

<RfrdDocAmt>

<DuePyblAmt Ccy="AUD">4073.00</DuePyblAmt>

<AdjstmntAmtAndRsn>

<Amt Ccy="AUD">0.00</Amt>

</AdjstmntAmtAndRsn>

<RmtdAmt Ccy="AUD">4073.00</RmtdAmt>

</RfrdDocAmt>

<CdtrRefInf>

<Tp>

<CdOrPrtry>

<Cd>SCOR</Cd>

</CdOrPrtry>

<Issr>ISO</Issr>

</Tp>

<Ref>2018-1202</Ref>

</CdtrRefInf>

</Strd>

</RmtInf>

</CdtTrfTxInf>

</PmtInf>

</CstmrCdtTrfInitn>

</Document>OTT payment with dealer rate

<?xml version="1.0" encoding="UTF-8"?>

<Document

xmlns:xsd="http://www.w3.org/2001/XMLSchema"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"

xmlns="urn:iso:std:iso:20022:tech:xsd:pain.001.001.03">

<CstmrCdtTrfInitn>

<GrpHdr>

<MsgId>1002278020</MsgId>

<CreDtTm>2018-12-14T12:08:23</CreDtTm>

<NbOfTxs>2</NbOfTxs>

<CtrlSum>10903.00</CtrlSum>

<InitgPty>

<Nm>TEST PAYER</Nm>

</InitgPty>

</GrpHdr>

<PmtInf>

<PmtInfId>1002278020</PmtInfId>

<PmtMtd>TRF</PmtMtd>

<NbOfTxs>2</NbOfTxs>

<CtrlSum>10903.00</CtrlSum>

<PmtTpInf>

<InstrPrty>NORM</InstrPrty>

<SvcLvl>

<Cd>URGP</Cd>

</SvcLvl>

<LclInstrm>

<Cd>IN</Cd>

</LclInstrm>

</PmtTpInf>

<ReqdExctnDt>2018-12-14</ReqdExctnDt>

<Dbtr>

<Nm>TEST PAYER</Nm>

<PstlAdr>

<StrtNm>Lee Street</StrtNm>

<TwnNm>Sydney</TwnNm>

<CtrySubDvsn>NSW</CtrySubDvsn>

<Ctry>AU</Ctry>

</PstlAdr>

<CtryOfRes>AU</CtryOfRes>

</Dbtr>

<DbtrAcct>

<Id>

<Othr>

<Id>123465</Id>

</Othr>

</Id>

<Ccy>AUD</Ccy>

</DbtrAcct>

<DbtrAgt>

<FinInstnId>

<BIC>WPACAU2S</BIC>

<ClrSysMmbId>

<MmbId>032-002</MmbId>

</ClrSysMmbId>

<PstlAdr>

<Ctry>AU</Ctry>

</PstlAdr>

<Othr>

<Id>032</Id>

</Othr>

</FinInstnId>

<BrnchId>

<Id>032-002</Id>

</BrnchId>

</DbtrAgt>

<CdtTrfTxInf>

<PmtId>

<InstrId>01-100080002083662019</InstrId>

<EndToEndId>8000208366</EndToEndId>

</PmtId>

<Amt>

<InstdAmt Ccy="USD">6830.00</InstdAmt>

</Amt>

<XchgRateInf>

<XchgRate>1.1</XchgRate>

<CtrctId>12345</CtrctId>

</XchgRateInf>

<ChrgBr>SHAR</ChrgBr>

<CdtrAgt>

<FinInstnId>

<BIC>GEBABEBB</BIC>

<ClrSysMmbId>

<MmbId>210</MmbId>

</ClrSysMmbId>

<Nm>BNP PARIBAS/ FORTIS BANK</Nm>

<PstlAdr>

<Ctry>BE</Ctry>

</PstlAdr>

</FinInstnId>

<BrnchId>

<Id>BRUSSELS</Id>

</BrnchId>

</CdtrAgt>

<Cdtr>

<Nm>CUSTOMER NAME</Nm>

<PstlAdr>

<StrtNm>TOUR SABLON</StrtNm>

<BldgNb>CUSTOMER TOWN</BldgNb>

<PstCd>1000</PstCd>

<TwnNm>TOWN</TwnNm>

<CtrySubDvsn>11</CtrySubDvsn>

<Ctry>BE</Ctry>

</PstlAdr>

<Id>

<OrgId>

<Othr>

<Id>0020018400</Id>

</Othr>

</OrgId>

</Id>

</Cdtr>

<CdtrAcct>

<Id>

<IBAN>BE85210047050106</IBAN>

</Id>

<Nm>CUSTOMER NAME</Nm>

</CdtrAcct>

<Tax>

<Cdtr>

<TaxId>BE0413393907</TaxId>

</Cdtr>

</Tax>

<RltdRmtInf>

<RmtLctnMtd>EMAL</RmtLctnMtd>

<RmtLctnElctrncAdr>test@customer.com</RmtLctnElctrncAdr>

</RltdRmtInf>

<RmtInf>

<Ustrd>Deal 343571</Ustrd>

<Strd>

<RfrdDocInf>

<Tp>

<CdOrPrtry>

<Cd>CINV</Cd>

</CdOrPrtry>

</Tp>

<Nb>1900047129</Nb>

<RltdDt>2018-11-15</RltdDt>

</RfrdDocInf>

<RfrdDocAmt>

<DuePyblAmt Ccy="AUD">6830.00</DuePyblAmt>

<AdjstmntAmtAndRsn>

<Amt Ccy="AUD">0.00</Amt>

</AdjstmntAmtAndRsn>

<RmtdAmt Ccy="AUD">6830.00</RmtdAmt>

</RfrdDocAmt>

<CdtrRefInf>

<Tp>

<CdOrPrtry>

<Cd>SCOR</Cd>

</CdOrPrtry>

<Issr>ISO</Issr>

</Tp>

<Ref>3184000436</Ref>

</CdtrRefInf>

</Strd>

</RmtInf>

</CdtTrfTxInf>

<CdtTrfTxInf>

<PmtId>

<InstrId>01-100080002083672019</InstrId>

<EndToEndId>8000208367</EndToEndId>

</PmtId>

<Amt>

<InstdAmt Ccy="EUR">4073.00</InstdAmt>

</Amt>

<XchgRateInf>

<XchgRate>1.2</XchgRate>

<CtrctId>54321</CtrctId>

</XchgRateInf>

<ChrgBr>SHAR</ChrgBr>

<CdtrAgt>

<FinInstnId>

<BIC>KBBECH22XXX</BIC>

<ClrSysMmbId>

<MmbId>00790</MmbId>

</ClrSysMmbId>

<Nm>Berner Kantonalbank AG</Nm>

<PstlAdr>

<Ctry>CH</Ctry>

</PstlAdr>

</FinInstnId>

</CdtrAgt>

<Cdtr>

<Nm>CUSTOMER NAME</Nm>

<PstlAdr>

<StrtNm>132 NEUFELDSTRASSE</StrtNm>

<PstCd>3012</PstCd>

<TwnNm>BERN</TwnNm>

<CtrySubDvsn>BE</CtrySubDvsn>

<Ctry>CH</Ctry>

</PstlAdr>

<Id>

<OrgId>

<Othr>

<Id>0020028401</Id>

</Othr>

</OrgId>

</Id>

</Cdtr>

<CdtrAcct>

<Id>

<IBAN>CH8000790016271905163</IBAN>

</Id>

<Nm>CUSTOMER NAME</Nm>

</CdtrAcct>

<RltdRmtInf>

<RmtLctnMtd>EMAL</RmtLctnMtd>

<RmtLctnElctrncAdr>test@customer.com</RmtLctnElctrncAdr>

</RltdRmtInf>

<RmtInf>

<Ustrd>Deal 343572</Ustrd>

<Strd>

<RfrdDocInf>

<Tp>

<CdOrPrtry>

<Cd>CINV</Cd>

</CdOrPrtry>

</Tp>

<Nb>1900047542</Nb>

<RltdDt>2018-10-28</RltdDt>

</RfrdDocInf>

<RfrdDocAmt>

<DuePyblAmt Ccy="AUD">4073.00</DuePyblAmt>

<AdjstmntAmtAndRsn>

<Amt Ccy="AUD">0.00</Amt>

</AdjstmntAmtAndRsn>

<RmtdAmt Ccy="AUD">4073.00</RmtdAmt>

</RfrdDocAmt>

<CdtrRefInf>

<Tp>

<CdOrPrtry>

<Cd>SCOR</Cd>

</CdOrPrtry>

<Issr>ISO</Issr>

</Tp>

<Ref>2018-1202</Ref>

</CdtrRefInf>

</Strd>

</RmtInf>

</CdtTrfTxInf>

</PmtInf>

</CstmrCdtTrfInitn>

</Document>RTGS payment

<?xml version="1.0" encoding="UTF-8"?>

<Document

xmlns:xsd="http://www.w3.org/2001/XMLSchema"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"

xmlns="urn:iso:std:iso:20022:tech:xsd:pain.001.001.03">

<CstmrCdtTrfInitn>

<GrpHdr>

<MsgId>1002274824</MsgId>

<CreDtTm>2018-12-13T13:02:01</CreDtTm>

<NbOfTxs>1</NbOfTxs>

<CtrlSum>20000000.00</CtrlSum>

<InitgPty>

<Nm>TEST PAYER</Nm>

</InitgPty>

</GrpHdr>

<PmtInf>

<PmtInfId>1002274824</PmtInfId>

<PmtMtd>TRF</PmtMtd>

<NbOfTxs>1</NbOfTxs>

<CtrlSum>20000000.00</CtrlSum>

<PmtTpInf>

<InstrPrty>NORM</InstrPrty>

<SvcLvl>

<Cd>URGP</Cd>

</SvcLvl>

</PmtTpInf>

<ReqdExctnDt>2018-12-13</ReqdExctnDt>

<Dbtr>

<Nm>TEST PAYER</Nm>

<PstlAdr>

<StrtNm>Lee Street</StrtNm>

<TwnNm>Sydney</TwnNm>

<CtrySubDvsn>NSW</CtrySubDvsn>

<Ctry>AU</Ctry>

</PstlAdr>

<CtryOfRes>AU</CtryOfRes>

</Dbtr>

<DbtrAcct>

<Id>

<Othr>

<Id>123465</Id>

</Othr>

</Id>

</DbtrAcct>

<DbtrAgt>

<FinInstnId>

<BIC>WPACAU2S</BIC>

<ClrSysMmbId>

<MmbId>032-002</MmbId>

</ClrSysMmbId>

<PstlAdr>

<Ctry>AU</Ctry>

</PstlAdr>

<Othr>

<Id>032</Id>

</Othr>

</FinInstnId>

<BrnchId>

<Id>032-002</Id>

</BrnchId>

</DbtrAgt>

<CdtTrfTxInf>

<PmtId>

<InstrId>01-100080002081682019</InstrId>

<EndToEndId>8000208168</EndToEndId>

</PmtId>

<Amt>

<InstdAmt Ccy="AUD">20000000.00</InstdAmt>

</Amt>

<ChrgBr>SHAR</ChrgBr>

<UltmtDbtr>

<Nm>TEST PAYER</Nm>

<PstlAdr>

<StrtNm>Test Street</StrtNm>

<TwnNm>Sydney</TwnNm>

<CtrySubDvsn>NSW</CtrySubDvsn>

<Ctry>AU</Ctry>

</PstlAdr>

<CtryOfRes>AU</CtryOfRes>

</UltmtDbtr>

<CdtrAgt>

<FinInstnId>

<BIC>WPACAU2S</BIC>

<ClrSysMmbId>

<MmbId>032-002</MmbId>

</ClrSysMmbId>

<Nm>Test WBC</Nm>

<PstlAdr>

<Ctry>AU</Ctry>

</PstlAdr>

</FinInstnId>

</CdtrAgt>

<Cdtr>

<Nm>TESt PAYER</Nm>

<PstlAdr>

<StrtNm>18 Test Street</StrtNm>

<PstCd>2008</PstCd>

<TwnNm>Chippendale</TwnNm>

<CtrySubDvsn>NSW</CtrySubDvsn>

<Ctry>AU</Ctry>

</PstlAdr>

</Cdtr>

<CdtrAcct>

<Id>

<Othr>

<Id>123465</Id>

</Othr>

</Id>

<Nm>TEST PAYER</Nm>

</CdtrAcct>

<UltmtCdtr>

<PstlAdr>

<StrtNm>18 Test Street</StrtNm>

<PstCd>2008</PstCd>

<TwnNm>Chippendale</TwnNm>

<CtrySubDvsn>NSW</CtrySubDvsn>

<Ctry>AU</Ctry>

</PstlAdr>

</UltmtCdtr>

<InstrForCdtrAgt>

<InstrInf>Test BS13.12.18</InstrInf>

</InstrForCdtrAgt>

<RmtInf>

<Strd>

<RfrdDocInf>

<Tp>

<CdOrPrtry>

<Cd>CINV</Cd>

</CdOrPrtry>

</Tp>

</RfrdDocInf>

<RfrdDocAmt>

<DuePyblAmt Ccy="AUD">20000000.00</DuePyblAmt>

<AdjstmntAmtAndRsn>

<Amt Ccy="AUD">0.00</Amt>

</AdjstmntAmtAndRsn>

<RmtdAmt Ccy="AUD">20000000.00</RmtdAmt>

</RfrdDocAmt>

<CdtrRefInf>

<Tp>

<CdOrPrtry>

<Cd>SCOR</Cd>

</CdOrPrtry>

<Issr>ISO</Issr>

</Tp>

</CdtrRefInf>

</Strd>

</RmtInf>

</CdtTrfTxInf>

</PmtInf>

</CstmrCdtTrfInitn>

</Document>Sample remittance

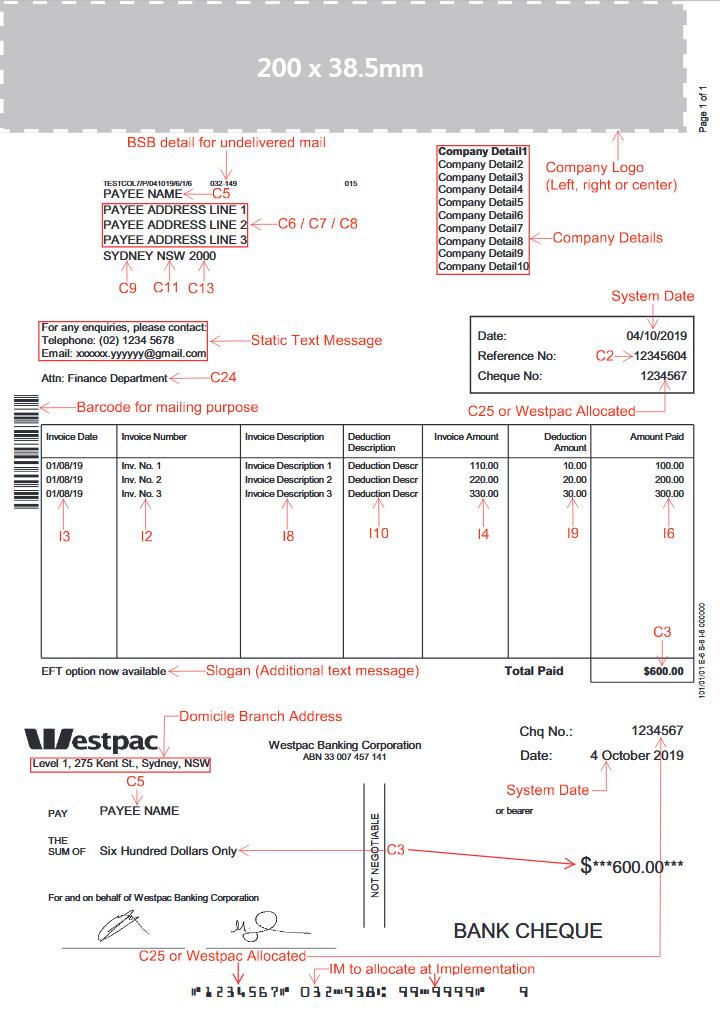

Specifying the remittance fields

- For printed (cheque) remittances, the field

<RmtLctnMtd>should be specified as 'POST'. - For emailed remittances the field

<RmtLctnMtd>should be specified as 'EMAL'.

| Field ID (See sample) | ISO XML Element | Length | Example |

|---|---|---|---|

| C2 - "Reference No" | <EndToEndId> |

See Specifying the End to End Id. Limited to 10 characters on printed remittances. | 12345604 |

| C3 - "Total Amount" | <InstdAmt> |

1-10, Maximum 9999999.99 | 600.00 |

| C5 - "Payee Name" | <Cdtr><Nm> |

1-35, An extended payee name length (100 chars) is possible upon request. | PAYEE NAME |

| C6 - "Street 1" | <Cdtr><PstlAdr><BldgNm> + <Cdtr><PstlAdr><StrtNm> |

1-35 | 100 High St |

| C9 - "City" | <TwnNm> |

35 characters for email, printed remittances are limited to 25 characters. | SYDNEY |

| C11 - "State" | <CtrySubDvsn> |

1-3 | NSW |

| C13 - "Post Code" | <PstCd> |

1-9 | 2000 |

| C24 - "Remarks" | <ChqInstr><MemoFld> |

1-35 | Attn: Finance Department |

| C25 - "Cheque Number" | May be provided or allocated by Westpac. If provided, use <ChqInstr><ChqNb> |

1-7 | 1234567 |

| I2 - "Invoice Number" | <RmtInf><Strd><CdtrRefInf><Ref> |

20 characters for email, printed remittances are limited to 10 characters. | Inv. No. 1 |

| I3 - "Invoice Date" | <RmtInf><Strd><RfrdDocInf><RltdDt> |

ISO Date | 01/08/19 |

| I4 - "Invoice Amount" | <RmtInf><Strd><RfrdDocAmt><DuePyblAmt> |

1-10, Maximum 9999999.99 | 110.00 |

| I6 - "Invoice Amount Paid" | <RmtInf><Strd><RfrdDocAmt><RmtdAmt> |

1-10, Maximum 9999999.99 | 100.00 |

| I8 - "Invoice Description" | <RmtInf><Strd><RfrdDocInf><Nb> |

1-35 | Invoice Description 1 |

| I9 - "Deduction Amount" | <RmtInf><Strd><RfrdDocAmt><AdjstmntAmtAndRsn><Amt> |

1-10, Maximum 9999999.99 | 10.00 |

| I10 - "Deduction Description" | <RmtInf><Strd><RfrdDocAmt><AdjstmntAmtAndRsn><AddtlInf> |

1-80 | Deduction Description 1 |

pain.002.001.03

PaymentsPlus responds to a pain.001.001.03 with three levels of pain.002.001.03 messages.

- An immediate response at the "Group level" once the file is validated

- A response after the file has been submitted to the bank for processing. This may be later if a delayed execution date is specified.

- A response once the transactions are processed and their status is known.

The levels are explained below.

Level 1 - File acknowledgement

An immediate response at the file level. Note that after this point a file may be split into many payment batches.

- If successful: PaymentsPlus accepts the file for processing.

- If not successful: You will need to look at the error inside the response, then fix and re-submit the entire file.

Level 2 - Payments sent out

A response after PaymentsPlus submits the payment batch to the bank for processing. PaymentsPlus sends this for scenarios involving future dated payments on the value date or authorisation. This response is optional.

- If successful: PaymentsPlus submits the payment batch to the wider banking system.

- If not successful: PaymentsPlus rejected the payment batch or it was manually cancelled. Re-submit the entire payment batch. Note: other batches in the original file may have been successful.

Level 3 - Payment result

A response after the banking network processed the transactions and the remote bank reported their status.

- If successful: The remote bank accepted the individual payment. Note: this does not necessarily mean that the funds are settled at this point.

- If not successful: Inspect the error for each individual failed transaction and re-try that payment.

Response filenames

Our standard response filenames are as follows, with <Datetime> in the format ddMMyyyyHHmmss.

| Type | Filename |

|---|---|

| Acknowledgement | PAIN002_<GrpHdr/MsgId>_<Datetime>_ACK.xml |

| Level 2 and 3 | PAIN002_<GrpHdr/MsgId><PmtInf/PmtInfId><Datetime>_CONF.xml |

Specification

A response file will be produced for each input file provided into PaymentsPlus. Additional remittance files may be produced to update payments which have been subsequently declined by other financial institutions.

| Lev | ISO element | Description | Example, element name where no value |

|---|---|---|---|

| 2 | <CstmrPmtStsRpt> |

||

| 3 | <GrpHdr> |

Group Header | |

| 4 | <MsgId> |

MessageIdentification | BBBB/120928-PSR/001 |

| 4 | <CreDtTm> |

CreationDateTime | 2018-09-28T14:09:00 |

| 4 | <InitgPty> |

InitiatingParty | |

| 5 | <Nm> |

Name | ABC Corporation |

| 5 | <PstlAdr> |

PostalAddress | |

| 6 | <StrtNm> |

StreetName | Times Square |

| 6 | <BldgNb> |

BuildingNumber | 7 |

| 6 | <PstCd> |

PostCode | NY 10036 |

| 6 | <TwnNm> |

TownName | New York |

| 6 | <Ctry> |

Country | US |

| 3 | <DbtrAgt> |

DebtorAgent | |

| 4 | <FinInstnId> |

FinancialInstitutionIdentification | |

| 4 | <BICFI> |

BICFI |

BBBBUS33 |

| 3 | <OrgnlGrpInfAndSts> |

OriginalGroupInformationAndStatus | |

| 4 | <OrgnlMsgId> |

OriginalMessageIdentification | ABC/120928/CCT001 |

| 4 | <OrgnlMsgNmId> |

OriginalMessageNameIdentification | pain.001.001.03 |

| 4 | <OrgnlCreDtTm> |

OriginalCreationDateTime | 2018-09-28T14:07:00 |

| 4 | <OrgnlNbOfTxs> |

OriginalNumberOfTransactions | 3 |

| 4 | <OrgnlCtrlSm> |

OriginalControlSum | 1.1500.000 |

| 4 | <GrpsSts> |

GroupStatus | ACCP |

| 3 | <OrgnlPmtInfAndSts> |

OriginalPaymentInformationAndStatus | |

| 4 | <OrgnlPmtInfId> |

OriginalPaymentInformationIdentification | 1002279930 |

| 4 | <PmtInfSts> |

PaymentInformationStatus | ACSP |

| 4 | <TxInfAndSts> |

TransactionInformationAndStatus | |

| 5 | <StsId> |

StatusIdentification | 2325063353 |

| 5 | <OrgnlInstrId> |

OriginalInstrumentIdentification | 01-200000010004702019 |

| 5 | <OrgnlEndToEndId> |

OriginalEndToEndIdentification | 0001000470 |

| 5 | <TxSts> |

TransactionStatus | ACSP |

| 5 | <StsRsnInf> |

StatusReasonInformation | |

| 6 | <Rsn> |

Reason | |

| 7 | <Cd> |

Code | See Response codes |

| 6 | <AddtlInf> |

AdditionalInformation | See Response codes |

Status descriptions

The following is a list of Status descriptions

Level 1 - File acknowledgement

| Status | Description |

|---|---|

| ACTC | Accepted, the file was loaded into PaymentsPlus for further validation and processing. |

| RJCT | Rejected, the file was rejected because of a validation or content error with the file. |

Level 2 - Payments sent out

| Status | Description |

|---|---|

| ACCP | Accepted, the payment was accepted and has been sent to the bank for processing and settlement. |

| RJCT | Rejected, the payment was rejected because of a validation or content error with payment details. |

Level 3 - Payment result

| Status | Description |

|---|---|

| ACSP | Accepted, the payment has processed successfully and has completed settlement at the bank. |

| RJCT | Rejected, the payment was rejected at the bank. |

Additional codes

These codes can occur for specific facilities and configurations in PaymentsPlus but are not used in standard solutions.

| Status | Description |

|---|---|

| PDNG | Pending |

| PART | Partial |

| RCVD | Received |

Sample files

Level 1 - File acknowledgement

<Document xmlns="urn:iso:std:iso:20022:tech:xsd:pain.002.001.03"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance">

<CstmrPmtStsRpt>

<GrpHdr>

<MsgId/>

<CreDtTm>2025-08-05T16:13:24</CreDtTm>

<InitgPty>

<Nm>TEST PAYER</Nm>

</InitgPty>

</GrpHdr>

<OrgnlGrpInfAndSts>

<OrgnlMsgId>1002278020</OrgnlMsgId>

<OrgnlMsgNmId>pain.001.001.03</OrgnlMsgNmId>

<OrgnlCreDtTm>2018-12-14T12:08:23</OrgnlCreDtTm>

<OrgnlNbOfTxs>60</OrgnlNbOfTxs>

<OrgnlCtrlSum>409800.00</OrgnlCtrlSum>

<GrpSts>ACTC</GrpSts>

</OrgnlGrpInfAndSts>

</CstmrPmtStsRpt>

</Document>

Level 2 - Payments sent out

<Document xmlns="urn:iso:std:iso:20022:tech:xsd:pain.002.001.03"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance">

<CstmrPmtStsRpt>

<GrpHdr>

<MsgId>8533133934</MsgId>

<CreDtTm>2025-08-01T17:26:50</CreDtTm>

<InitgPty>

<Nm>TEST PAYER</Nm>

</InitgPty>

</GrpHdr>

<OrgnlGrpInfAndSts>

<OrgnlMsgId>1002279829</OrgnlMsgId>

<OrgnlMsgNmId>pain.001.001.03</OrgnlMsgNmId>

<OrgnlCreDtTm>2025-08-01T14:46:03</OrgnlCreDtTm>

<OrgnlNbOfTxs>1</OrgnlNbOfTxs>

<OrgnlCtrlSum>70.00</OrgnlCtrlSum>

</OrgnlGrpInfAndSts>

<OrgnlPmtInfAndSts>

<OrgnlPmtInfId>1002279930</OrgnlPmtInfId>

<PmtInfSts>ACCP</PmtInfSts>

</OrgnlPmtInfAndSts>

</CstmrPmtStsRpt>

</Document>Level 3 - Payment result

<Document

xmlns="urn:iso:std:iso:20022:tech:xsd:pain.002.001.03"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance">

<CstmrPmtStsRpt>

<GrpHdr>

<MsgId>8533133934</MsgId>

<CreDtTm>2018-12-14T15:01:53</CreDtTm>

<InitgPty>

<Nm>TEST PAYER</Nm>

</InitgPty>

</GrpHdr>

<OrgnlGrpInfAndSts>

<OrgnlMsgId>1002279829</OrgnlMsgId>

<OrgnlMsgNmId>pain.001.001.03</OrgnlMsgNmId>

<OrgnlCreDtTm>2018-12-14T14:20:19</OrgnlCreDtTm>

<OrgnlNbOfTxs>2</OrgnlNbOfTxs>

<OrgnlCtrlSum>828.95</OrgnlCtrlSum>

</OrgnlGrpInfAndSts>

<OrgnlPmtInfAndSts>

<OrgnlPmtInfId>1002279930</OrgnlPmtInfId>

<PmtInfSts>ACSP</PmtInfSts>

<TxInfAndSts>

<StsId>2325063353</StsId>

<OrgnlInstrId>01-200000010004702019</OrgnlInstrId>

<OrgnlEndToEndId>0001000470</OrgnlEndToEndId>

<TxSts>ACSP</TxSts>

</TxInfAndSts>

</OrgnlPmtInfAndSts>

<OrgnlPmtInfAndSts>

<OrgnlPmtInfId>1002279931</OrgnlPmtInfId>

<PmtInfSts>RJCT</PmtInfSts>

<TxInfAndSts>

<StsId>2325063354</StsId>

<OrgnlInstrId>01-200000010004702020</OrgnlInstrId>

<OrgnlEndToEndId>0001000471</OrgnlEndToEndId>

<TxSts>RJCT</TxSts>

<StsRsnInf>

<Rsn>

<Cd>AC03</Cd>

</Rsn>

<AddtlInf>AccountNumber: Invalid New Zealand account details.</AddtlInf>

</StsRsnInf>

</TxInfAndSts>

</OrgnlPmtInfAndSts>

</CstmrPmtStsRpt>

</Document>